Recent Why SERVPRO Posts

3 Hidden Areas Mold Can Grow

8/27/2022 (Permalink)

Three Secret Places Mold Can Grow

Is your home in Wichita, KS, showing signs of mold growth? There is more to mold than meets the eye, and it's best to be informed about the hidden severities and damages it can cause.

1. Behind Walls

Moldy drywall is a serious issue, namely because there is often more to it than meets the eye. If mold is visible on your drywall, it's also likely that it is growing inside the wall as well. Usually, mold growth starts behind the wall where it's dark and humid, then it works its way out through the drywall. If you've had any water leaks in your home recently, the water may have settled behind the wall and encouraged the growth of mold.

2. Under Flooring

Mold around flooring follows the same trend as mold in and around drywall. Depending on the type of flooring you have, you may see the floor being to buckle if any water is present. Wood flooring is especially prone to this, so keep an eye out for any mold on wood. A spongey floor that gives under the weight of your foot is also a sign that water is present, and, thus, mold is able to grow as well. These are both indicators that you should call in a professional for proper mold inspection and cleanup.

3. Around Sinks

Water and moisture are ideal conditions for mold to grow. If you have a leaking sink, be sure to check the entire surroundings for mold growth. If there is mold visible on any surfaces, be sure to check under and around those surfaces thoroughly. Additionally, if you notice any unpleasant smells coming from your sink drain, it's almost certain that there is mold growing there. Garbage disposals are also prone to this if they are not cleaned regularly.

Mold can grow nearly anywhere given the right conditions, but if an informed homeowner can identify issues and call in a professional, mold can easily and safely be taken care of.

FEMA Grants: Offering Support to Those Without Flood Insurance

7/12/2022 (Permalink)

FEMA Grants

Flood insurance is a wonderful tool and may even be a requirement in some areas. Unfortunately, if you are not located near a flood plane, then specialty insurance isn’t a requirement, leaving you vulnerable to the occasional flooding experienced in Colwich, KS. Thankfully, FEMA offers grants to people in these situations.

1. Do You Qualify?

In order to qualify for a flood grant, your area must be declared a disaster area by the federal government. If you are in such an area and have sustained damage to your property or home during the designated timeframe, then you qualify to apply for disaster assistance.

2. What Do Grants Cover?

While flood insurance can limit the scope of coverage, FEMA grants can be used to cover several expenses.

- Home restoration and repair

- Temporary housing

- Medical expenses

- Funeral costs

Granted, a grant will not cover personal property loss or other common issues, but it will help you begin the restoration process.

3. What If You’re Not Eligible?

While a grant is an excellent option for those living in designated areas, not everyone will be eligible. For those who are ineligible, the Small Business Administration offers assistance through low-interest loans for homeowners and renters. These loans are income dependent.

4. What Will an SBA Loan Cover?

An SBA loan can be used to cover personal property loss, moving expenses, and even vehicle repair or replacement. Additionally, these loans can be used to hire an emergency restoration company for extensive home repairs and renovations.

Flood insurance is a wonderful tool to have, but it is not always required and may be overlooked by many homeowners as nonessential. Fortunately, when flooding occurs, and homeowners don’t have insurance, FEMA and the SBA offers financial grants and loans to help. Don’t let a lack of coverage leave you vulnerable. If your area is designated as a disaster site, you could have assistance today.

How To Save Money on Building Maintenance

5/30/2022 (Permalink)

Reducing Maintenance Expenses

Managing a building in Colwich, KS can be expensive. The maintenance cost of a property is particularly high. However, there are ways to save money on repairs. Check out these tips for reducing maintenance expenses.

1. Do Not Forget About Preventative Maintenance

If you have limited staff, it can be easy to skip basic preventative maintenance tasks. However, regularly checking the roof, HVAC systems and walls for signs of problems is vital. Poorly maintained structures may quickly fail during a storm, necessitating extensive emergency remediation services. Spending money on preventative measures now will thus save you money and limit your stress going forward.

2. Consider New Facility Management Strategies

Even if you do discover an issue during your routine checks, you can limit the costs of your repairs. For instance, if one part of your equipment is malfunctioning, consider replacing just the broken parts rather than the entire unit.

3. Double-Check Safety Equipment

After you purchase safety equipment such as carbon monoxide detectors, you cannot just assume they will work. Regularly test the items and upgrade them if necessary. You are better off spending a bit more on this maintenance cost now instead of spending thousands of dollars on damage repairs and litigation expenses after a storm.

4. Consider Grants

Green nonprofits offer incentives for eco-friendly maintenance measures. You could get funding for insulation and boiler upgrades that will protect your building and renters during a storm.

5. Boost the Company's Culture

Whichever cost-cutting initiatives you implement, you will need your workers to accept the changes. Teach your employees why the moves are necessary and what the benefits will be. You must get your team members to rally around the measures you create.

As a residential property manager, you should take steps to limit your maintenance cost. These tips should keep your premises functional while limiting the hit to your wallet.

4 Steps To Take After a Basement Flood

5/23/2022 (Permalink)

Steps To Take When Your Basement Floods

The basement is a common location of home floods. After all, water can easily enter the basement during storms. This is especially true if your basement walls and floors are improperly sealed. Yet a flood can even occur in dry conditions. Common sources of basement flooding include:

- Hot water tanks

- Broken supply lines

- Sump pumps

- Downspouts

No matter the cause of the flood, you need to act quickly to minimize the damage. Here are four steps to take when your basement floods.

1. Locate the Source of the Basement Flood

First, you should figure out what caused the buildup of water. This will then determine your next steps. If the flood is due to a storm, wait for the bad weather to pass before attempting any cleanup. If the excess water came from an internal fixture such as a pipe, turn off the valve that is supplying water to the basement. This should prevent the flooding from getting any worse.

2. Call the Pros

Call your insurance provider and your local emergency restoration company as soon as possible. Ideally, they will work together to get your home repaired.

3. Protect Yourself

If you decide to enter the flooded basement, you need to keep yourself safe. Do not touch any stereos, lights or other electronics. Be sure to also wear protective gear, including gloves, boots and a mask.

4. Take Initial Measures To Limit the Damage

Large jobs such as pipe repair should only be done by professionals. However, once you have the proper protective gear, you can start a bit of the cleanup yourself. Use a sump pump, mop or wet vacuum to remove the water. You should also take any wet items out of the basement and place them in a ventilated area where they can dry.

If you encounter flooding in the basement of your Salina, KS, home, there is no need to panic. Just follow the above suggestions, and your house should soon be back to normal.

How To Keep Insurance Claim Costs Down With SERVPRO

2/23/2022 (Permalink)

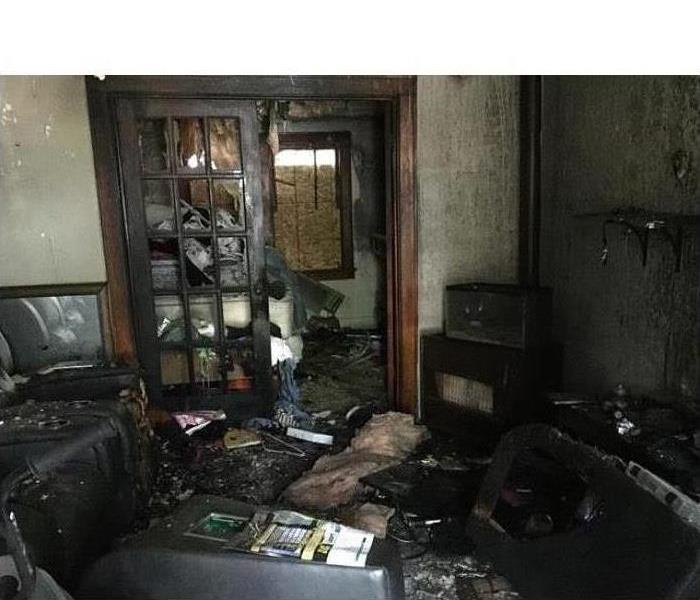

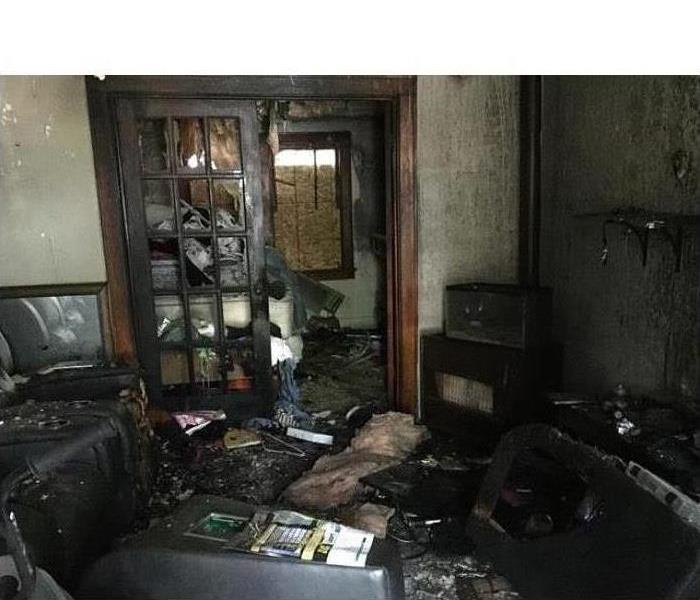

Fire damage in a Valley Center, KS home.

Fire damage in a Valley Center, KS home.

SERVPRO Shows You How To Keep Insurance Claim Costs Low

If a client has experienced a disaster in his or her Valley Center, KS home and has fire or water damage as a result, using a trusted restoration company can help you provide them with needed assistance while keeping insurance costs down. SERVPRO can provide services, such as pretesting, that will help both you and your client get through the claims process.

1. 24-Hour Service To Get the Process Started As Soon As Possible

The company is open at all hours, so you won’t have to wait to begin working through the insurance claim process. A quick response is important during an emergency and getting started sooner can save you both time and money.

2. Mitigation To Prevent Further Damage

If damage is not treated immediately, it will get worse and end up requiring more work when the company starts repairs. Mitigation is an important part of restoration and will be done within four hours when you work with SERVPRO. This will prevent the damage from spreading or worsening so that repairs will be less costly. It will also allow them to finish the job more quickly.

3. Pretesting To Determine Restorability

If your client’s property has been damaged, it is possible that it might need to be replaced. SERVPRO will do pretesting on each damaged item to determine if this will be the case. Because it takes less money to restore an object than it does to replace it, this step can help keep costs down if items are found to be salvageable.

4. Providing Access to Detailed Information

SERVPRO can provide the insurance agent with information that can help you make the right call when filing the insuring claim. They can give you an inventory of damaged items with corresponding pictures as well as access to their Claims Information Center where you can find information related to the claim.

When your client files an insurance claim, you want to make sure that you are doing whatever you can for them while also keeping costs down for the insurance agency. The right damage restoration company can help you do both.

24/7 Emergency Service

24/7 Emergency Service